Elite Methods for Achieving Optimal Wrist Function

Targeted Exercises for Enhanced Wrist Strength and Flexibility

Strengthening Your Wrist Flexors

Targeted exercises focusing on wrist flexors are crucial for improving overall wrist strength and flexibility. These muscles are responsible for bending your wrist downwards, and neglecting them can lead to imbalances and potential injuries. Incorporating exercises like wrist curls with light weights or resistance bands, performed with controlled movements, can effectively build strength and endurance in these critical areas. Consistency is key; aim for 2-3 sets of 10-15 repetitions daily, gradually increasing the weight or resistance as your strength improves.

Another effective exercise is the reverse wrist curl. While seemingly simple, this exercise targets the opposing muscles, the wrist extensors, which are equally important for wrist health and function. Performing reverse wrist curls helps create a balanced muscle development crucial for preventing imbalances that may lead to discomfort or injury. Remember to maintain a slow, controlled tempo during the exercise to avoid any sudden movements that could put unnecessary stress on the joints.

Developing Wrist Extensor Strength

Building wrist extensor strength is just as important as strengthening the flexors. These muscles are responsible for extending your wrist upwards. Exercises like wrist extensions with dumbbells or resistance bands are excellent for this purpose. By targeting these muscles, you are helping to improve the overall stability and control of your wrist, reducing the risk of injuries from repetitive movements. Be sure to focus on controlled movements, avoiding jerky motions that can strain the muscles and potentially cause injury. Consistency in this exercise is equally important as other wrist strengthening activities.

Performing wrist extensions with a resistance band offers an alternative to weights. Resistance bands provide a variable level of resistance, enabling you to progressively challenge your muscles as you get stronger. Furthermore, they are portable and convenient, allowing you to incorporate these exercises into your workouts anywhere. Gradually increasing the resistance of the band as you improve will help you continue to challenge your muscles and promote continued strength gains.

Improving Wrist Flexibility and Mobility

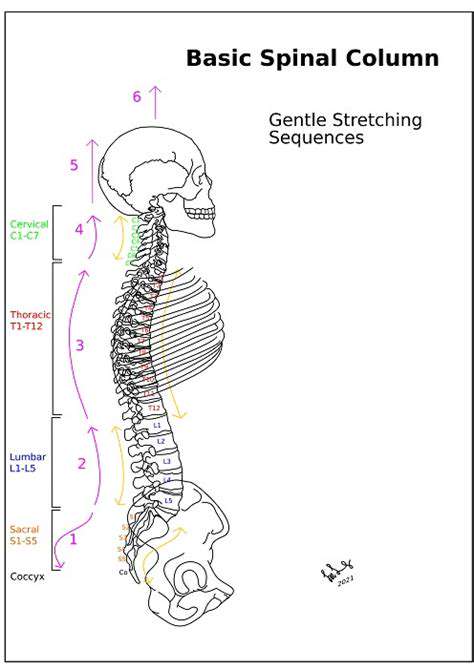

Beyond strength training, incorporating wrist flexibility and mobility exercises is vital for overall wrist health. Stretching exercises that target the wrist flexors and extensors, along with the surrounding tendons and ligaments, can significantly improve range of motion and prevent stiffness. Wrist stretches like wrist circles, gentle flexion, and extension movements are all beneficial ways to improve flexibility. These stretches should be performed slowly and gently to avoid straining any muscles or tendons. Regular stretching can also help alleviate any existing wrist pain or discomfort.

Another important aspect of wrist mobility is the focus on proper posture. Maintaining a neutral wrist position during daily activities, like typing or using a mouse, can significantly reduce strain on the wrist joints. Proper posture not only improves wrist flexibility and mobility but also reduces the risk of developing repetitive strain injuries. By incorporating these techniques into your daily routine, you can enhance the health and function of your wrists while improving overall movement.

Incorporating wrist stretches into your daily routine, even in short bursts, can greatly improve flexibility. Simple wrist circles, and stretches that gently bend the wrist in both directions, are excellent ways to promote flexibility. Aim for at least 5-10 minutes of dedicated wrist stretching each day, especially before and after activities that involve repetitive wrist movements. Consistency in these exercises will help to maintain and improve wrist flexibility over time.

Advanced Strategies for Long-Term Wrist Health Maintenance

Understanding Market Dynamics

Long-term investment success hinges on a deep understanding of market trends and economic cycles. Analyzing historical data, assessing current conditions, and projecting future possibilities are crucial for navigating potentially volatile markets. This involves staying informed about interest rate changes, inflation pressures, and global geopolitical events, all of which can significantly impact investment portfolios over extended periods.

Diversification for Risk Mitigation

Diversification is a cornerstone of long-term investment strategies. It involves spreading investments across various asset classes, such as stocks, bonds, real estate, and alternative investments, to reduce the impact of market fluctuations on a single investment. By diversifying your portfolio, you're essentially reducing your overall risk exposure, protecting your capital and potentially increasing your returns over time. A well-diversified portfolio can weather market downturns more effectively.

Developing a Robust Investment Plan

A comprehensive investment plan is essential for long-term success. This plan should outline your financial goals, risk tolerance, and desired investment timeframe. It should also detail specific strategies for achieving those goals, including asset allocation strategies, regular contributions, and rebalancing your portfolio as needed. This structured approach will keep you on track and help you stay disciplined in the face of market volatility. Regular review and adjustments are vital as your circumstances change.

Strategic Asset Allocation

Strategic asset allocation involves determining the optimal mix of different asset classes within your portfolio. This allocation should be based on your risk tolerance, financial goals, and investment horizon. Allocating a greater portion of your portfolio to assets with the potential for higher returns, such as stocks, might be appropriate for younger investors with a longer time horizon. Conversely, those nearing retirement might favour a more conservative allocation with a greater emphasis on fixed-income securities.

Implementing Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help mitigate the risk of investing large sums at unfavorable market peaks. By consistently investing over time, you benefit from purchasing more units when prices are low and fewer when prices are high. This strategy can lead to a lower average cost per unit and potentially enhance long-term returns.

Regular Portfolio Review and Rebalancing

Regular portfolio reviews and rebalancing are vital for maintaining the effectiveness of your long-term investment strategy. These reviews allow you to assess your progress toward your financial goals and make necessary adjustments to ensure your portfolio aligns with your current circumstances and risk tolerance. Monitoring market conditions and adjusting your portfolio as needed is critical for long-term success. It allows you to maintain the desired asset allocation and potentially capitalize on emerging opportunities.